🔓vlY2K

After YIP:1 has successfully passed, we are ready to introduce $Y2K and $vlY2K.

$Y2K is the governance token that will be used to define important parameters of the Y2K ecosystem. $Y2K is available for trading in the following Balancer Pool: Y2K : wETH

$Y2K can be further locked for $vlY2K, allowing lockers to accumulate a larger share of governance power and accrue protocol fee revenue. Note that vanilla $Y2K is not eligible for protocol revenue distributions.

$vlY2K is a locked 80Y2K:20wETH BPT. The BPT is a Balancer Pool Token that serves as the liquidity base for Y2K, this token can be obtained by providing liquidity in the Y2K Balancer pool. More information on BPT’s is available: here. This pool token can be locked for 2 periods: 16 weeks and 32 weeks. Note that $vlY2K is non-transferable.

Obtaining $vlY2K

IFO Participants

Claim $Y2K rewards on the “Claim Page”

Provide 80Y2K : 20wETH Liquidity to the Balancer pool

Lock the LP token for 16 or 32 weeks on the “Lock” page of the Dapp

New Participants

Buy $Y2K on the Balancer Pool

Provide 80Y2K : 20wETH Liquidity to the Balancer pool

Lock the LP token for 16 or 32 weeks on the “Lock” page of the Dapp

Locking

As mentioned above, $Y2K holders will be able to provide liquidity in the Balancer LP and lock that LP token for $vlY2K. The lock has 2 periods: 16 weeks and 32 weeks. 32 week lockers will receive 2x more protocol fees and governing power than 16 week lockers to ensure protocol alignment.

Fee Accrual

$vlY2K holders are eligible for 50% of all protocol fees generated on Y2K, the other 50% is reserved in the DAO Treasury for protocol maintenance, this allocation is based on the ongoing YIP:2 proposal which is set to conclude on December 20th.

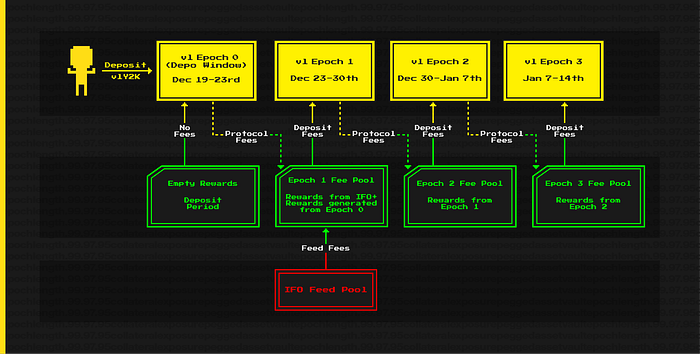

Locks are grouped into weekly vl Y2K epochs which start on Friday December 23rd at 23:59 UTC. Deposits during the current epoch do not count towards currently active epoch fee distributions. Users need to lock their $Y2K for $vlY2K before the beginning of the epoch to be eligible for protocol revenue of that epoch. The first epoch will begin on Friday December 23 at 23:59 UTC, and will follow a weekly structure thereafter, as such, users need to lock prior to December 23 23:59 UTC to be eligible for epoch 1 rewards.

Note: the first epoch will be allocated 50% of all of the IFO protocol fees on top of the current vault epoch revenue. Hence the first $vlY2K epoch will have a vastly outsized reward rate.

Governing Power

Based on the outcome of YIP:1, $Y2K tokens have 1 vote, $Y2K locked for 16 weeks have 5 votes, $Y2K locked for 32 weeks have 10 votes.

Gauge System to determine Liquidity Mining distributions

Currently, liquidity mining emission direction is done via a pre-launch team member committee. With the introduction of $vlY2K a portion of liquidity mining emission direction will be done via a gauge system.

Gauges are contracts that allow $vlY2K lockers to direct which markets (vaults) to allocate $Y2K emissions to. Gauges will follow Snapshot votes that will include all available markets, with $Y2K token emissions being allocated to the said markets based on the outcome of the vote. The voting power of $vlY2K will be based on the lock period.

Decentralizing the emissions allocations allows for a Bribe Market to establish around the said emissions, and $vlY2K holders will be able to rent out their voting rights on the Hidden Hand marketplace soon after launch of the Gauge system.

Last updated